AA/WARC: 2019 UK ad spend forecast to fall 16.7% in 2020

The latest AA/WARC Expenditure Report reflects the impact of COVID-19 on the UK’s advertising sector

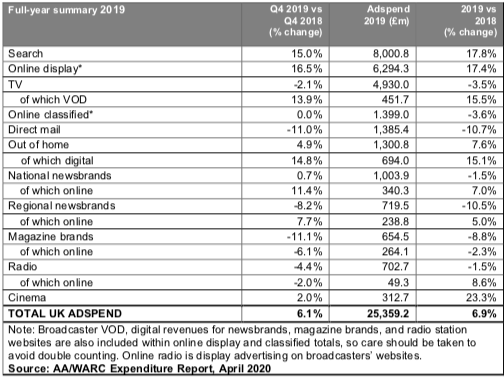

The latest Advertising Association/WARC Expenditure Report shows that while UK ad spend rose 6.9% year-on-year to reach £25.36 billion in 2019, the 10th consecutive year of ad market growth, the forecast for 2020 and 2021 has been adjusted to account for the economic impact of the COVID-19 pandemic.

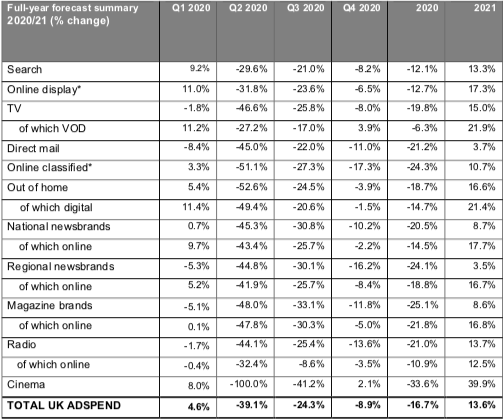

Prior to the COVID-19 outbreak, the forecast ad spend growth in 2020 was a 5.2% rise to a total of over £26 billion. The revised forecast is for advertising expenditure of £21.13 billion, meaning a year-on-year reduction of 16.7% – or £4.23bn – from 2019. Ad spend is expected to return to growth in 2021 with a rise of 13.6%, but the report states that absolute levels of investment are not expected to surpass the 2019 total.

Online and digital formats performed strongly during the past year and they are forecast to decline by less than traditional formats over 2020. Search and online display grew by 17.8% and 17.4% respectively in 2019 but are predicted to fall by 12.1% and 12.7% respectively this year. Video on demand (VOD) recorded growth of 15.5% in 2019 and is expected to see a 6.3% fall in investment this year. This is expected to rebound to 21.9% in 2021. While out-of-home advertising is expected to see a decline in investment in 2020, DOOH is expected to record among the largest gains in 2021 with a rise of 21.4%.

Commenting on the report, the Advertising Association’s CEO Stephen Woodford said: “Instinct might tell businesses to be cautious in their advertising at this time and we all need to be mindful of the unusual times we’re living in. But at the same time, the importance of advertising during a downturn cannot be overstated. The vast majority of ad spend, around 90%, will still be invested this year and businesses should ensure they are in the best possible place – and best possible shape – to take advantage of a return to growth when it comes. History shows the brands that emerge fastest and strongest are those that invest in advertising during a downturn.”

At IAB UK, we’re working with our members and the digital ad industry to help support businesses at this time. As part of this, we’ve created IAB UK Connected to house a range of resources, including financial support advice and insight on audience trends. Take a look here.

Earlier this week we also released full-year digital ad spend data for 2019. While the results don’t reflect the current situation, they do give us a clear picture of where the digital ad industry stood going into the crisis and will be helpful as we chart routes to recovery. Read our CEO Jon Mew’s piece on it here.

Related content

AA/WARC: UK ad spend surpasses £10bn in Q3 2024

Learn moreUK ad spend to reach record £10.5bn during festive season

Learn moreAA/WARC: UK ad spend reaches £19.6bn in H1 2024

Learn moreAA/WARC: UK ad spend reaches record £9.2bn in Q1 2024

Learn more

Rediscover the joy of digital advertising

Champion connections instead of clicks. Capture audiences' imaginations, not just their attention. Boldly find your own beat instead of letting tech set the pace. It’s time to rediscover the joy of digital.