AA/WARC: Digital drives growth as UK ad spend hits record £32bn

Posted on Thursday 28 April 2022 | IAB UK

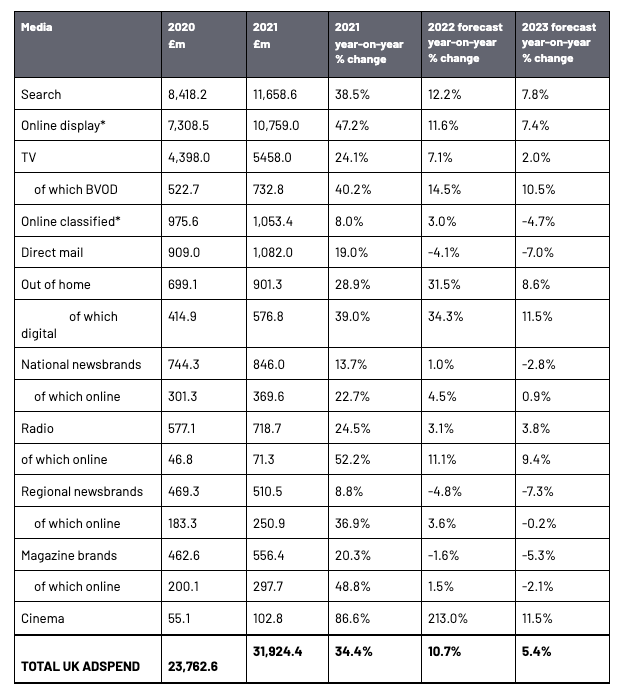

The UK ad market reached a record £31.9bn in 2021, equating to growth of 34.3% year-on-year, according to the full year 2021 Advertising Association/WARC Expenditure Report

The latest AA/WARC full year figures reveal the 2021 ad market emerged £8bn larger than April 2020’s original forecast of £24bn set at the beginning of the COVID-19 pandemic. This growth is in part due to inflationary pressures on the cost of advertising, but also a higher-than-expected growth in key forms of online advertising during the past year.

Three in every four pounds spent on UK advertising today is invested in one of a wide range of online formats. IAB UK’s Digital Adspend Report produced with PwC, which feeds into the AA/WARC report, shows that digital ad spend totalled £23.5bn in 2021 - a 41% year-on-year growth and 50% vs 2019, before the pandemic hit.

The data also shows that search, inclusive of search shopping ads, proved to be the strongest performer in 2021 – attracting £11.7bn in ad spend and beating April 2020's projection (made during the onset of the COVID-19 pandemic) by over £3.7bn. Video display ads overperformed by approximately £2bn and social media display by £2.3bn in relation to the forecasts made at the start of the pandemic.

To accompany the latest Expenditure Report, the AA has also released a new report to explore the extraordinary ad spend growth seen during the recovery from the COVID-19 pandemic: ‘UK Advertising’s Adspend Review: The Pandemic Effect’. It includes contributions from WARC, Credos (the UK’s advertising’s think tank); and industry perspectives from AA members, including Google, Tesco, News UK and UM.

What’s next?

The latest AA/WARC data presents an upgrade to the previous forecasts for 2022. The UK's ad market is forecast to grow by 10.7% in 2022 to £35.3bn, driven by a strong start to the year, higher CPMs and higher demand ahead of the FIFA World Cup. In 2023, this is set to add an additional 5.4% year-on-year to reach £37.2bn, though economic headwinds – particularly in relation to cost of living pressures and supply chain disruption – mean this is liable to review.

Stephen Woodford, Chief Executive, Advertising Association, said: “The UK has held its position in 2021 as the largest advertising market in Europe through the pandemic and is now the third largest in the world, behind the USA and China. While further growth is forecast, inflationary pressures on the cost of advertising, and more generally, due to the ongoing geo-political uncertainties, mean we should be cautious.”

James McDonald, Director of Data, Intelligence & Forecasting, WARC said: “The COVID 19 recovery last year was buoyed in part by the release of pent-up investment on established online platforms – as well as maturing ones such as TikTok – and in part by the emergence of retail media as a major contender for marketing budgets. The latter trend bears the hallmark of a new era in advertising, one which is set to fuel growth over the forecast period and beyond.

“Be that as it may, economic headwinds create uncertainty ahead; the consumer is being stretched further than at any other time since the Second World War, conflict in Europe has stoked market volatility and has exacerbated supply chain pressures, and the prospect of a UK recession cannot be ignored. Given the market’s current momentum, however, we do not yet see this translating into an advertising recession over the coming quarters.”

Full year 2021 AA/WARC Expenditure Report results

Related content

AA/WARC: UK ad spend surpasses £10bn in Q3 2024

Learn moreUK ad spend to reach record £10.5bn during festive season

Learn moreAA/WARC: UK ad spend reaches £19.6bn in H1 2024

Learn moreAA/WARC: UK ad spend reaches record £9.2bn in Q1 2024

Learn more

Rediscover the joy of digital advertising

Champion connections instead of clicks. Capture audiences' imaginations, not just their attention. Boldly find your own beat instead of letting tech set the pace. It’s time to rediscover the joy of digital.